This week’s blog series examines the meal kit industry through the lens of Blue Apron. In 2012, Blue Apron was one of the first meal kit companies to enter the market. Earlier iterations of today’s meal kit industry exist, but the current version still functions primarily as a large-scale e-commerce industry, despite recent forays into the brick and mortar grocery segment. By shipping fresh meat and produce across the country (and in some cases, internationally) with easy recipes and a novel cooking experience for busy professionals, parents, specialty diet consumers, and other customer segments, the industry has seen extreme growth in a short amount of time. And in this case, Blue Apron took only three years to be valued at $2 billion (Filloon, 2019).

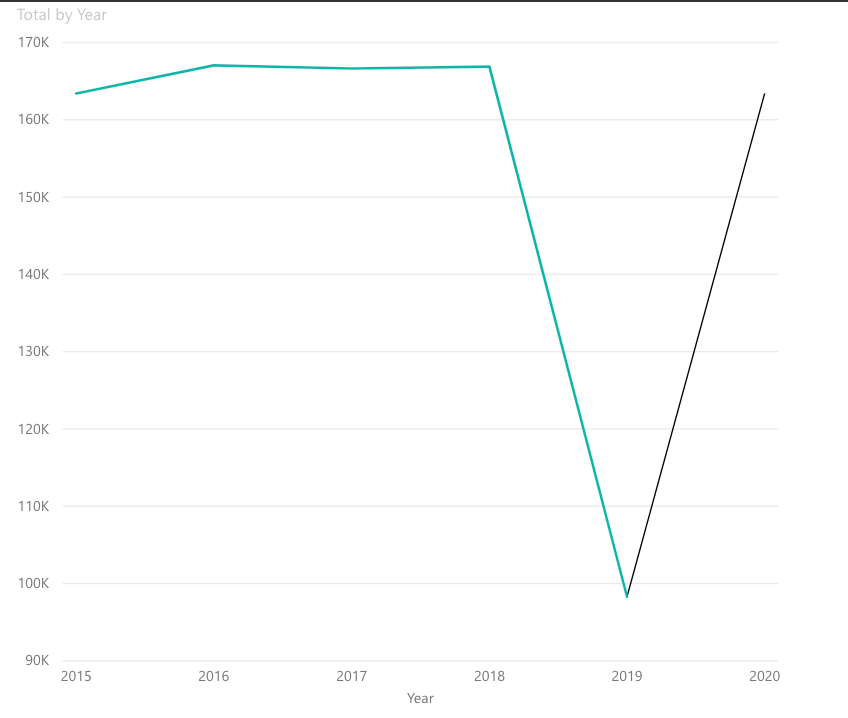

Figure 1 shows Blue Apron’s projected growth over the past year.

Figure 1. Blue Apron’s drop in a select, representative sample segment of the country with projected growth in 2019 previously reported to shareholders.

Growth was expected to be on an upward trend in 2019, which was excellent. With new brand partnerships and changes to the supply chain it seemed inevitable. However, the growth projections predated reports of a food contamination scare at Blue Apron. [Fictional scenario for the purposes of this assignment.] Luckily, the affected food was identified, disposed of, and no one was harmed. But since the report surfaced, profits actually dropped significantly, the opposite of projections. Blue Apron cannot afford to continue the deep dive seen in profits in the last year.

Blue Apron is a high-profile brand that has suffered significant and public losses, since it is the only publicly traded meal kit company. Therefore, much like a condominium in a rocky real estate market, Blue Apron will be hit harder than other brands and also take longer to recover. This was proven when a different meal kit brand had a similar scare that sent Blue Apron’s profits downward simply by association of being in the same industry, as seen in Figure 1 last year. Therefore, to avoid another contamination problem and insulate itself from problems at other meal kit companies, Blue Apron must implement and market a sizable food safely culture initiative. It will require major, highly publicized enhancements to food safety measures, corporate policies, and employee training.

Post #2 in this series explores a risk avoidance analysis that could contribute to shoring up Blue Apron’s efforts in this area.

Reference

Filloon, W. (2019, February 26). Is This the Death Rattle of Mail-Order Meal Kits? [Blog post] Retrieved from https://www.eater.com/2019/2/26/18239767/meal-kits-bubble-grocery-stores-blue-apron-hello-fresh-doomed