Sun Basket’s long-term strategy most certainly includes the specialty diets detailed in last week’s posts. Specifically, the Mediterranean diet is an area of great growth potential for the company. And with a staff level of about 775 employees (Sun Basket’s Competitors, Revenue, Number of Employees, Funding and Acquisitions, 2019), the longevity of the company affects the lives of many people and their families. So, it behooves Sun Basket to take a critical look at its approach to personnel management and engagement.

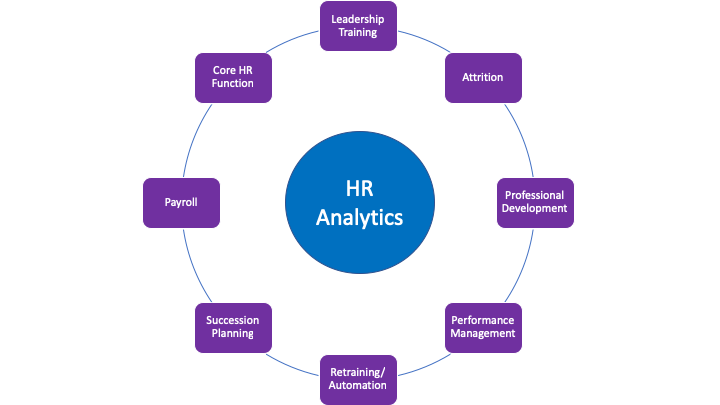

Figure 1 shows the areas to which Sun Basket should pay particular attention. Of note are the categories of leadership training, retraining/automation, and attrition. For leadership training, when employees feel more invested in and supported by the place that employs them, they’re more engaged in making the company better. Leadership training not only enhances the overall experience of trained employees and their coworkers, but it’s also an attractive development program that seeds loyalty to the company while being an attractive resume element and source of professional development.

Figure 1. HR Analytics areas of opportunity for development.

The category of retraining/automation is particularly relevant since the Midwest branch of the company was just shut down since the east and west coasts were determined to provide the required infrastructure to deliver meal kits to 97% of the country without compromising quality (Saxe, 2019). Thankfully, Sun Basket’s CEO appears to be invested in the well-being of the company’s employees. The automation plans for the remaining facilities are not aimed at replacing people but instead aimed at enabling people to focus more on optimizing procedures instead of focusing on producing items. Therefore, a highly skilled workforce can earn more and invest in making the company better. And it appears that the CEO plans to train current employees into those roles, which is much better than laying people off and also taking on the risk of bad press for such a high-profile company.

And finally, attrition is a related category in which Sun Basket should invest time and resources. It’s expensive to recruit and train new people. It’s much less expensive to retain the people already employed at the company. While substandard employees can still be released through policies and procedures like professional development, the anticipated increased demand as the consumer base grows can better be met when the employees are happy, healthy, and are given all the necessary tools to be productive and engaged members of the company.

Post #9 in this series explores an operations analysis.

References

Saxe, L. (2019, June 7). Sun Basket To Close Midwest Plant And Focus On Profitability [Blog post]. Retrieved from https://www.forbes.com/sites/lizzysaxe/2019/06/07/sun-basket-to-close-midwest-plant-and-focus-on-profitability/#4c9a99951f74

Sun Basket’s Competitors, Revenue, Number of Employees, Funding and Acquisitions. (2019). Retrieved from https://www.owler.com/company/sunbasket